Medicare is a vital part of retirement planning, providing essential health coverage for millions of Americans aged 65 and older. But simply enrolling in Medicare isn’t enough. To get the most value from your benefits, it’s important to understand how the system works, what options are available, and how to tailor your plan to your needs.

At Senior Insurance Advisors, we specialize in helping retirees navigate the complexities of Medicare. Our team is here to ensure that you not only get the coverage you need but also maximize your benefits and savings for a healthy, secure retirement.

Understand the Basics of Medicare

To make the most of your benefits, start with a clear understanding of the different parts of Medicare:

- Medicare Part A covers hospital stays, skilled nursing facility care, and hospice.

- Medicare Part B includes outpatient care, doctor visits, and preventive services.

- Medicare Part C, or Medicare Advantage is an all-in-one alternative to Original Medicare, often including extra benefits like dental, vision, and prescription coverage.

- Medicare Part D provides standalone prescription drug coverage.

Knowing what each part covers, and what it doesn’t, is the first step in choosing the right plan for your lifestyle and budget.

Enroll at the Right Time

Timing is everything when it comes to Medicare. Missing your Initial Enrollment Period (IEP) can lead to late enrollment penalties and gaps in coverage.

Your IEP begins three months before your 65th birthday, includes the month you turn 65, and ends three months after. If you’re still working and covered by employer insurance, you may qualify for a Special Enrollment Period (SEP) later.

Our licensed advisors at Senior Insurance Advisors can help you navigate Medicare enrollment to avoid unnecessary costs and ensure continuous coverage.

Consider a Medicare Advantage Plan

Medicare Advantage plans (Part C) often provide greater value by bundling multiple benefits into a single plan. These plans are offered by private insurers approved by Medicare and can include:

- Dental and vision coverage

- Hearing aids

- Gym memberships and wellness programs

- Prescription drug coverage

Some plans even offer transportation services and telehealth options—important perks for retirees. To see if Medicare Advantage is right for you, visit our Medicare Advantage page.

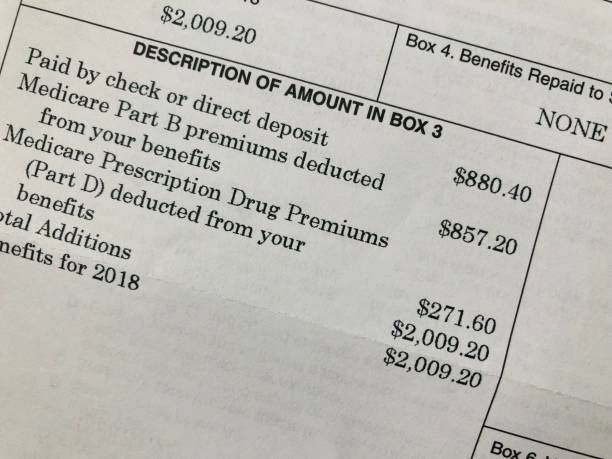

Don’t Overlook Prescription Drug Coverage

Prescription drugs can be a significant expense in retirement. Whether you choose Original Medicare with a Part D plan or a Medicare Advantage plan that includes drug coverage, it’s important to review your medications each year to ensure your plan still meets your needs.

Our team at Senior Insurance Advisors can conduct a free Medicare plan review to help you compare your options. Learn more about how we can help on our Medicare Part D page.

Take Advantage of Preventive Services

Medicare offers a wide range of preventive services at no cost, including:

- Annual wellness visits

- Cancer screenings

- Flu shots

- Cardiovascular screenings

- Diabetes prevention programs

Staying proactive with your health can help you catch conditions early—and avoid costly treatments down the road.

Review and Adjust Your Plan Annually

Your health needs and budget can change from year to year, which is why it’s important to review your Medicare coverage annually during Open Enrollment (October 15 – December 7). During this time, you can:

- Switch from Original Medicare to Medicare Advantage or vice versa

- Change your Medicare Advantage plan

- Enroll in or switch Part D plans

At Senior Insurance Advisors, we offer free annual Medicare reviews to help you stay informed and covered.

Work with a Licensed Medicare Advisor

Choosing the right Medicare plan can be overwhelming—but you don’t have to do it alone. A licensed advisor can help you:

- Understand plan benefits and costs

- Avoid coverage gaps and penalties

- Tailor your plan to your specific health needs and lifestyle

- Save money on premiums and prescriptions

Our advisors provide personalized Medicare guidance. We’re here to simplify the process and help you make confident, informed decisions.

Get the Most Out of Your Medicare in Retirement

Maximizing your Medicare benefits isn’t just about saving money, it’s about ensuring peace of mind as you enjoy retirement. With the right plan and expert guidance, you can get better coverage, avoid surprises, and stay healthy for the years ahead.

Ready to get started?

Schedule your free Medicare review today with one of our licensed advisors at Senior Insurance Advisors, your trusted partner in Medicare and retirement planning.