As we approach 2025, significant changes are on the horizon for Medicare Part D that will impact how prescription drug coverage is managed for seniors. In this blog, we'll breakdown the upcoming changes mandated by the Centers for Medicare & Medicaid Services (CMS) and what they mean for you or your loved ones. Here is everything you need to know about Medicare Part D Changes in 2025.

How is Medicare Part D Changing in 2025

1. Prescription Payment Plan

Beginning January 1, 2025, the Inflation Reduction Act mandates all Medicare Part D plans, including standalone Medicare prescription drug plans and Medicare Advantage plans with prescription drug coverage, to offer a Prescription Payment Plan. This plan allows enrollees to pay out-of-pocket prescription drug costs through capped monthly installment payments instead of all at once at the pharmacy. This option is particularly beneficial for those facing high cost sharing early in the plan year, as it spreads out expenses over time.

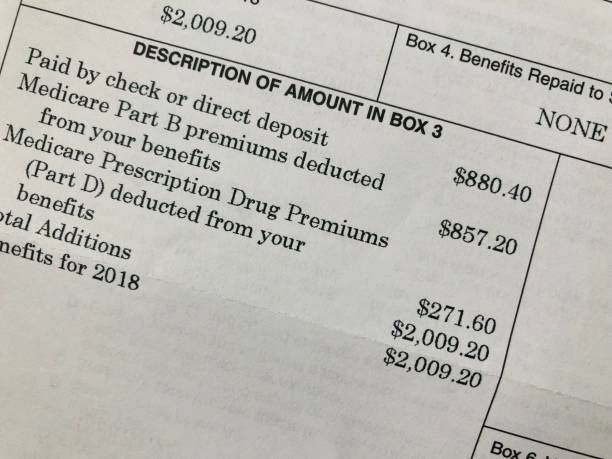

2. Removal of Coverage Gap/Donut Hole

Thanks to the Inflation Reduction Act, starting in 2025, annual out-of-pocket costs for Medicare Part D enrollees will be capped at $2,000. The coverage gap (commonly known as the "donut hole") will now be eliminated. This means you will no longer experience a gap in coverage where you are responsible for higher out-of-pocket costs for prescription drugs.

3. Impact on Prescription Drug Costs

Seniors enrolled in Medicare Part D can expect potential savings on their prescription drug expenses due to these changes. The redesigned benefit structure aims to address the rising costs of medications and ensure that beneficiaries have access to necessary treatments without facing excessive out-of-pocket expenses.

What You Need to Do

As these changes take effect, it's important for Medicare beneficiaries to stay informed and proactive. Here are steps you can take to stay ahead of the curve:

- Review your current Medicare Part D plan to understand how it may be affected.

- October 1st start consulting with a trusted insurance advisor to explore new plan options that align with your healthcare needs and budget.

- Stay updated on communications from CMS and your healthcare providers. Look out for your Annual Notice of Change letter from your carrier in September, which will detail any coverage and cost changes effective January 1st.

Senior Insurance Advisors is Here to Help

At Senior Insurance Advisors, we specialize in navigating Medicare and are dedicated to helping you understand and benefit from these new Medicare Part D changes. Our team can provide personalized guidance, evaluate your coverage options, and ensure you have the right plan in place for 2025 and beyond.

The upcoming changes to Medicare Part D in 2025 represent a huge step forward in enhancing prescription drug affordability and access for seniors. By staying informed, you can navigate these changes confidently and ensure that your healthcare needs are met effectively.

To schedule a free consultation and learn more about how these changes may impact you, contact Senior Insurance Advisors today. We're here to support you in making informed decisions about your Medicare Part D coverage.