Medicare provides essential health coverage for millions of Americans, but many people are surprised to learn that it doesn’t cover everything. Gaps in Medicare coverage can leave beneficiaries responsible for significant out-of-pocket costs. Understanding what Medicare doesn’t cover—and how to protect yourself financially—can help you make informed decisions about your healthcare.

What Medicare Doesn't Cover

While Medicare Parts A and B (Original Medicare) cover hospital stays, doctor visits, and certain medical services, they do not include several important healthcare expenses:

1. Dental, Vision, and Hearing Care

Medicare does not cover routine dental exams, cleanings, fillings, dentures, eyeglasses, or hearing aids. These services are essential for maintaining overall health, yet they can be costly without supplemental insurance.

2. Long-Term Care

If you need help with daily activities such as bathing, dressing, or eating, Medicare won’t cover extended stays in a nursing home or assisted living facility. Medicaid may help those who qualify financially, but most individuals will need other planning strategies.

3. Prescription Drugs

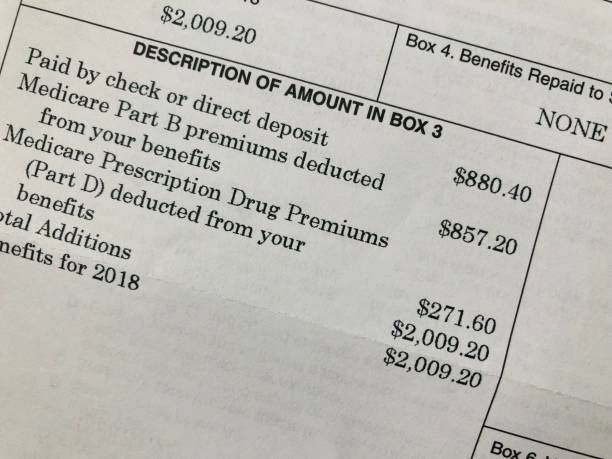

Original Medicare does not cover most prescription medications. Beneficiaries must enroll in a Medicare Part D plan or choose a Medicare Advantage plan that includes drug coverage to help with these costs.

4. Overseas Medical Care

If you travel outside the U.S., Medicare typically won’t cover your healthcare expenses. Without supplemental insurance, you could face high medical bills if you need care while abroad.

5. Alternative and Cosmetic Treatments

Medicare does not cover acupuncture (except for certain cases of chronic pain), chiropractic care beyond spinal adjustments, or elective cosmetic procedures.

How to Fill the Gaps in Medicare Coverage

Fortunately, there are several ways to protect yourself from the costs Medicare doesn’t cover:

1. Medicare Supplement Plans (Medigap)

Medigap policies help pay for expenses such as copayments, deductibles, and coinsurance. These plans, offered by private insurers, can reduce your out-of-pocket costs and provide peace of mind.

Learn more about Medicare Supplement Plans →

2. Medicare Advantage Plans

Many Medicare Advantage (Part C) plans include additional benefits such as dental, vision, hearing, and even wellness programs. These plans are a great alternative to Original Medicare, offering broader coverage under a single policy. Medicare Part D provides prescription drug coverage and is sold by private insurance companies. Most Medicare enrollees purchase prescription drug coverage as an addition to their Medicare coverage.

Learn more about Medicare Advantage (Part C) →

3. Standalone Dental, Vision, and Hearing Insurance

Since Medicare doesn’t cover routine dental, vision, or hearing care, separate insurance policies can help cover these essential services.

4. Long-Term Care Insurance

Long-term care insurance can help cover the costs of assisted living, nursing homes, and in-home care, reducing the financial burden on families.

5. Travel Insurance with Medical Coverage

If you travel frequently, investing in a travel insurance plan that includes emergency medical

coverage can provide peace of mind.

Get Expert Guidance on Medicare Coverage

Navigating Medicare’s complexities can be overwhelming, but you don’t have to do it alone. At Senior Insurance Advisors, we help individuals understand their Medicare options and find the best supplemental coverage to meet their needs. Contact us today to ensure you have the protection and benefits you need for a secure and healthy future!