Top 10 Red Flags to Watch Out for When Choosing a Medicare Insurance Agent

Top 10 Red Flags to Watch Out for When Choosing a Medicare Insurance Agent

Navigating Medicare can be overwhelming, especially with all the plans, rules, and changes that happen year after year. A trustworthy Medicare insurance agent can make the process smoother, clearer, and tailored to your needs. But not all agents have your best interests at heart. Whether you’re new to Medicare or reviewing your current plan, it’s essential to recognize the warning signs that you might not be dealing with the right agent.

Here are the top 10 red flags to look out for when choosing a Medicare insurance agent:

1. They Push One Insurance Company Only

A reliable Medicare agent should offer multiple carriers and plan options, not just one. If they constantly promote only one company without explaining why it suits you best, you may be dealing with a captive agent or someone more focused on commission than your needs.

2. They Promise Too Much

Be cautious if an agent guarantees extra benefits, huge savings, or "secret" perks. Medicare is standardized and regulated—no one can promise you a miracle plan that no one else can access. If it sounds too good to be true, it probably is.

3. They Skip the Needs Assessment

A good agent will ask about your doctors, medications, preferred pharmacies, travel habits, and budget before recommending a plan. If an agent jumps straight into selling you something without understanding your situation, that’s a red flag.

4. They Rush You to Enroll

If you’re being pressured to sign up on the spot, take a step back. A trustworthy agent will give you time to compare plans, ask questions, and even consult family or advisors.

5. They Don’t Explain the Fine Print

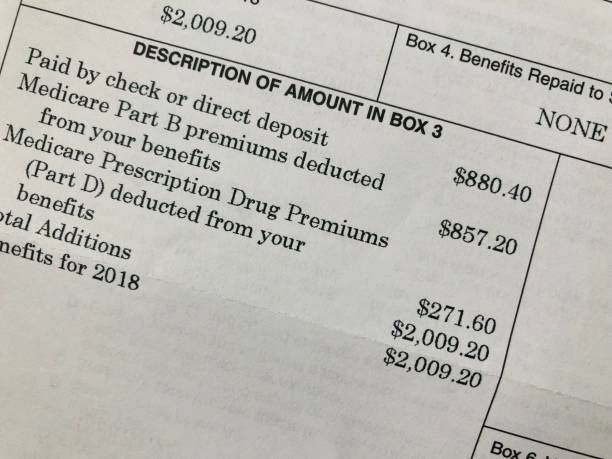

Medicare Advantage and Part D plans come with rules, networks, co-pays, and coverage phases. If an agent glosses over these details, it could cost you later. You need to understand what you're signing up for.

6. They Avoid Putting Things in Writing

Every conversation and recommendation should be documented. If an agent hesitates to give you a summary in writing, or won't email you details, that’s suspicious. Transparency is non-negotiable.

7. They’re Not Licensed or Certified

Agents must be licensed in your state and certified annually to sell Medicare Advantage and Part D plans. Always verify their credentials. You can check with your state’s Department of Insurance.

8. They Ignore Your Doctors and Medications

Your preferred providers and prescriptions should be central to plan selection. If an agent doesn’t check formulary coverage or provider networks, you might end up in a plan that doesn’t meet your needs.

9. They Don’t Disclose Their Compensation

Agents are usually paid by insurance companies, not by you. But ethical agents will explain this clearly and won’t steer you toward plans based solely on commissions. If an agent seems evasive about this, be cautious.

10. They Disappear After You Enroll

Support shouldn't end after enrollment. A good Medicare agent will offer ongoing help—answering questions, helping with appeals, and checking in during the Annual Enrollment Period. If they vanish after you sign, that's a major red flag.

Final Thoughts

Choosing a Medicare plan is a big decision. The right agent should act as your advocate—someone who listens, explains, and genuinely wants to help. If you spot any of these red flags, trust your instincts and seek help elsewhere. Your health and financial well-being are too important to leave in the hands of someone who isn’t looking out for you.

Senior Insurance Advisors is your trustworthy partner to help you with Medicare

We’ll begin with a brief conversation to understand your specific needs—like your medications, preferred doctors, and what you want from your coverage. Then we’ll compare plans from several top companies and explain the differences in clear, simple terms. There’s no pressure at all—you’ll have all the time you need to make a confident, informed decision. Get in touch today to book your no-cost consultation.