How Caregivers Can Help Loved Ones Prepare for Medicare Annual Enrollment

The Medicare Annual Enrollment Period (AEP) is a crucial time for seniors to evaluate their healthcare coverage. For caregivers, this period offers an opportunity to ensure that loved ones have the most suitable and cost-effective Medicare plan. Understanding the AEP and how to assist during this time can significantly impact the quality of care and financial well-being of those you support.

What Is the Medicare Annual Enrollment Period?

Medicare AEP runs annually from October 15 to December 7. During this window, beneficiaries can:

- Switch from Original Medicare to a Medicare Advantage Plan (Part C) or vice versa.

- Change Medicare Advantage plans.

- Enroll in, drop, or switch Medicare Part D (prescription drug) plans.

- Make changes to Medigap (Medicare Supplement) policies if eligible.

Any changes made during this period take effect on January 1 of the following year.

How Caregivers Can Assist Loved Ones

1. Understand the Available Medicare Plans

Familiarize yourself with the different Medicare options:

- Original Medicare (Parts A & B): Provides hospital and medical coverage.

- Medicare Advantage (Part C): An alternative to Original Medicare, often including additional benefits like vision, dental, and prescription drug coverage.

- Medicare Part D: Offers prescription drug coverage.

- Medigap: Supplemental insurance to cover costs not paid by Original Medicare.

Understanding these options helps in comparing plans and selecting the best fit for your loved one's healthcare needs.

2. Review Current Healthcare Needs

Assess your loved one's health status, including:

- Chronic conditions or ongoing treatments.

- Preferred healthcare providers and hospitals.

- Current medications and prescription needs.

- Budget for healthcare expenses.

This review ensures that the chosen plan aligns with their specific requirements.

3. Compare Medicare Plans

Utilize online tools and resources to compare different Medicare plans. Pay attention to:

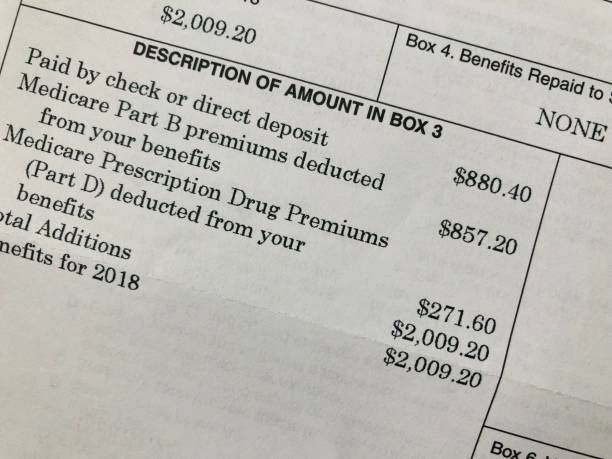

- Monthly premiums.

- Deductibles and out-of-pocket costs.

- Coverage for prescription drugs.

- Network of healthcare providers.

Resources like Medicare.gov and PlanEnroll.com offer plan comparison tools to assist in this process.

4. Seek Professional Guidance

Consider consulting with Medicare advisors or insurance agents who specialize in senior healthcare plans. They can provide personalized advice and help navigate the complexities of Medicare. Senior Insurance Advisors offer free consultations to assist in selecting the appropriate coverage.

5. Ensure Proper Documentation

To manage your loved one's Medicare plan effectively, ensure you have the necessary documentation:

- Authorization forms allowing you to discuss their health information.

- Durable Power of Attorney (DPOA) if you need to make decisions on their behalf.

- Medicare cards and records of previous coverage.

Having these documents facilitates smoother interactions with healthcare providers and insurance companies.

6. Monitor and Adjust Plans Annually

Medicare plans can change annually, affecting coverage and costs. Regularly reviewing and adjusting the plan ensures that it continues to meet your loved one's needs. Set reminders to evaluate their plan each year during the AEP.

Tips for Caregivers

- Stay Organized: Keep a file with all Medicare-related documents, including plan details and correspondence.

- Communicate Clearly: Discuss plan options with your loved one, considering their preferences and comfort.

- Be Proactive: Start the review process early to avoid last-minute decisions.

- Utilize Available Resources: Take advantage of community workshops, online webinars, and informational sessions offered by local agencies or insurance providers.

How Senior Insurance Advisors Can Help

Senior Insurance Advisors specialize in simplifying the Medicare process for seniors and their caregivers. They offer:

- Free consultations with no obligation to enroll.

- Assistance in comparing and selecting Medicare plans.

- One-on-one support to address specific concerns.

- Educational resources to empower informed decision-making.

Their goal is to ensure that seniors receive the coverage they need without confusion or unnecessary costs.

Final Thoughts

The Medicare Annual Enrollment Period is an essential time for seniors to reassess their healthcare coverage. As a caregiver, your support in navigating this process can lead to better health outcomes and financial savings for your loved one. By staying informed, seeking professional guidance, and maintaining open communication, you can make this process more manageable and beneficial for those you care for. Contact Senior Insurance Advisors for a free consultation.