Many people approaching their 65th birthday know that they should be thinking about enrolling in Medicare but aren’t sure where to start. We know how daunting the process can be, so we have compiled a Medicare enrollment checklist for individuals who will soon be entering their Initial Enrollment Period.

1. Confirm Your Eligibility

People sometimes confuse their Social Security retirement age with their Medicare eligibility date. Whether you are retired or not, you become eligible for Medicare coverage at age 65. Individuals enrolling in Medicare must have lived in the United States for at least the 5 consecutive years preceding their enrollment application. If you meet this requirement and are also turning 65, you are eligible to apply for coverage during a Medicare Initial Enrollment Period (IEP).

2. Identify Your IEP

The Medicare Initial Enrollment Period is made up of a 7-month window. Your IEP consists of the month of your 65th birthday and the 3 months immediately before and after. For example, someone who will turn 65 in January of 2022 will have an IEP that extends from October of 2021 through April of 2022.

You should be mindful of your IEP for a couple of reasons. First, missing out on your IEP enrollment opportunity could result in a late enrollment penalty. This penalty can range from a one-time fee to a premium increase across the lifetime of your plan depending upon the types of Medicare coverage you carry. Second, your IEP is also the only time you can enroll in Medigap coverage without the requirement to provide health history information. A Medigap enrollment attempt outside of your IEP could result in an elevated premium or outright denial of coverage, depending upon an insurance provider’s assessment of your health history.

3. Gather Necessary Documents

Enrollment in Medicare requires verification of eligibility data such as your age, citizenship status, and work or military history. If you are already receiving Social Security benefits, retirement or otherwise, the Social Security Administration may already have some of this information on file. Even if this is the case, you should locate the following documents before your IEP:

- Your birth certificate—a certified copy from the issuing agency is acceptable if you have misplaced the original

- Proof of citizenship or permanent residency

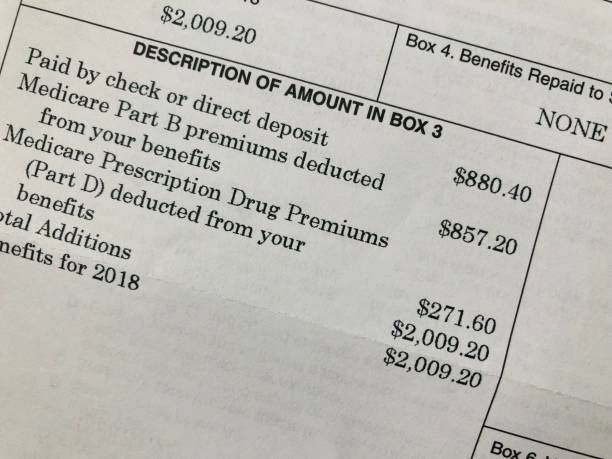

- Income statements from your most recent year of employment

- Discharge paperwork for military service occurring before 1968

- Your most recent Social Security benefits statement, if applicable

4. Do Your Research

If you are already receiving Social Security or Railroad Retirement Board (RRB) benefits as of your 65th birthday, you can be automatically enrolled in Medicare Parts A and B. If you are not yet receiving retirement benefits when you turn 65, you will need to enroll in the Medicare plan of your choice on your own. In either case, it is important to understand the different Medicare options available. There are a number of factors to consider when determining what kind of Medicare plan is right for you.

Check with your primary care physician, pharmacy, or specialist to confirm whether they accept Medicare. Medicare Advantage plans can also limit your provider choices to their specific network, making it more difficult or expensive to continue seeing a health care provider you trust. If you take prescription medicine, you should verify that the Part C or D plan you are considering includes your existing prescriptions in their formulary list of covered options. Ensuring that you can afford your plan of choice is also a decision-making factor, whether you are able to pay your premiums and out-of-pocket costs independently or would require Extra Help.

5. Enroll in Medicare

Once you have chosen a plan and have entered your IEP window, it’s time to enroll. You may choose to enroll in Medicare online, over the phone, or in-person. Using the personal documents and knowledge you have collected, you will have all the information you need to complete your application. Once your Original Medicare enrollment is complete, you can also add in any additional Medicare coverage you may need.

Still have questions about Medicare or the Initial Enrollment Period? We would love to hear from you! Senior Insurance Advisors hosts Welcome to Medicare events twice a month to guide you through the enrollment process at no cost to you. We also offer one-on-one meetings and employer education options to help you feel confident about choosing coverage based on your needs. Drop us a line today to learn how we are simplifying Medicare.