Choosing the right Medicare coverage is an important decision, and for many people, Medicare Advantage plans offer an attractive option. These plans combine medical, hospital, and often prescription drug coverage into one plan, along with extra benefits not offered by Original Medicare.

Here’s a closer look at why someone might choose a Medicare Advantage plan and who may benefit most.

1. Lower Monthly Premiums

One of the main reasons people choose Medicare Advantage is the low monthly premium. Many plans offer premiums as low as $0 (in addition to the Part B premium), making them appealing for individuals on a fixed income.

This cost structure works well for people who prefer lower upfront costs and are comfortable with cost-sharing when services are used.

2. All-in-One Medicare Coverage

Medicare Advantage plans bundle:

- Medicare Part A (hospital coverage)

- Medicare Part B (medical coverage)

- Often Medicare Part D (prescription drug coverage)

Having everything under one plan simplifies coverage, billing, and plan management.

3. Extra Benefits Beyond Original Medicare

Many Medicare Advantage plans include benefits not covered by Original Medicare, such as:

- Dental, vision, and hearing coverage

- Over-the-counter (OTC) allowances

- Healthy food benefits

- Fitness memberships (e.g., SilverSneakers)

- Transportation to medical appointments

These added benefits can create real value for members who use them.

4. Annual Out-of-Pocket Maximum

Unlike Original Medicare, Medicare Advantage plans include an annual out-of-pocket maximum. Once you reach this limit, the plan covers 100% of covered medical services for the remainder of the year.

This feature provides financial protection and peace of mind for those concerned about large medical expenses.

5. Coordinated Care and Provider Networks

Many Medicare Advantage plans emphasize coordinated care through primary care providers and established networks. This can help streamline care, reduce duplication of services, and improve communication between providers.

This structure works well for individuals who prefer an organized healthcare approach.

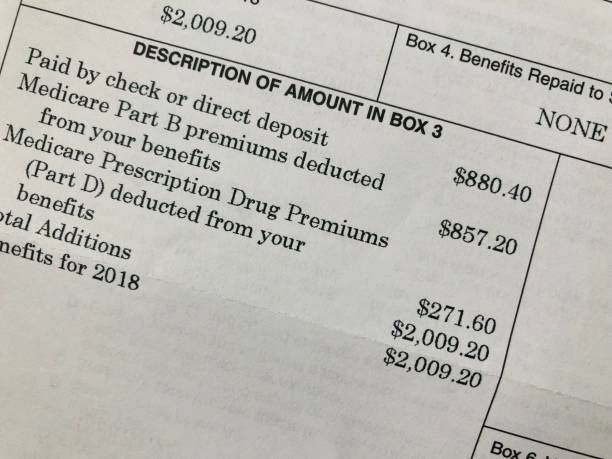

6. Prescription Drug Coverage Included

Most Medicare Advantage plans include prescription drug coverage, eliminating the need to enroll in a separate Part D plan. This can simplify coverage and potentially reduce overall costs for members with routine medications.

7. A Good Fit for Certain Lifestyles

Medicare Advantage plans may be ideal for individuals who:

- Are generally healthy

- Are comfortable using provider networks

- Do not travel frequently

- Want predictable, lower monthly costs

- Value extra benefits like dental and vision

For these members, Medicare Advantage can offer strong coverage at an affordable price.

Final Thoughts

Medicare Advantage plans offer affordable premiums, bundled coverage, and valuable extra benefits, making them a good option for many people. However, they are not the right fit for everyone due to networks and plan rules.

The best Medicare choice depends on health needs, budget, and lifestyle. Understanding how Medicare Advantage works allows individuals to choose coverage confidently and avoid surprises.

Not sure which Medicare option is right for you?

Contact Senior Insurance Advisors for personalized guidance and help choosing coverage that fits your needs and budget.