Choosing the right healthcare coverage during retirement is one of the most important decisions you’ll make. With multiple Medicare options available, it’s common to feel overwhelmed — especially when comparing Medicare Advantage vs. Medigap plans. While both options can provide valuable coverage, they work very differently and are designed for different retirement needs.

At Senior Insurance Advisors, we help retirees and those approaching Medicare eligibility understand their options clearly, so they can choose a plan that fits their lifestyle, budget, and long-term healthcare goals.

Understanding Medicare Advantage and Medigap

Before comparing the two, it’s important to understand what each option is and how it fits into the Medicare system.

Medicare Advantage plans (Part C) are offered by private insurance companies and replace Original Medicare (Part A and Part B). These plans provide the same core coverage as Original Medicare but often bundle additional benefits such as prescription drug coverage, dental, vision, and hearing services into one plan.

Medigap plans, also known as Medicare Supplement plans, work alongside Original Medicare. Rather than replacing it, Medigap helps pay out-of-pocket costs like deductibles, copayments, and coinsurance that Original Medicare does not cover. You cannot have both a Medicare Advantage plan and a Medigap plan at the same time, you must choose one or the other.

Key Differences Between Medicare Advantage vs. Medigap

Understanding how these plans differ can help you determine which option best aligns with your retirement needs.

How Coverage Is Structured

With Medicare Advantage, the plan becomes your primary coverage. All your care is managed through the private insurance plan, often with bundled benefits and structured cost-sharing.

With Medigap, Original Medicare remains your primary insurance, and the Medigap policy fills in coverage gaps. This structure can lead to fewer surprise medical bills and more predictable healthcare expenses.

Provider Access and Flexibility

One major difference between Medicare Advantage vs. Medigap is provider access.

Medigap plans typically allow you to see any doctor or specialist who accepts Medicare, without needing referrals or staying within a network. This flexibility is especially valuable for retirees who travel frequently or want unrestricted access to providers.

Medicare Advantage plans often use provider networks, meaning you may need to stay in-network to receive the lowest costs. While emergency care is still covered outside the network, routine care may be more limited.

Monthly Premiums and Out-of-Pocket Costs

Medicare Advantage plans often feature lower monthly premiums, and some plans have very minimal upfront costs beyond your Medicare Part B premium. However, out-of-pocket expenses can add up depending on how often you use healthcare services.

Medigap plans generally have higher monthly premiums, but they often result in lower out-of-pocket costs when you receive care. For many retirees, this predictability makes budgeting for healthcare easier.

Additional Benefits

Medicare Advantage plans may include extra benefits such as dental, vision, hearing, fitness programs, and wellness services. These benefits can be appealing for individuals who want comprehensive coverage under one plan.

Medigap plans focus strictly on medical coverage and do not usually include these extras. However, many retirees prefer Medigap for its simplicity and broad provider access.

Prescription Drug Coverage

Many Medicare Advantage plans include prescription drug coverage as part of the plan.

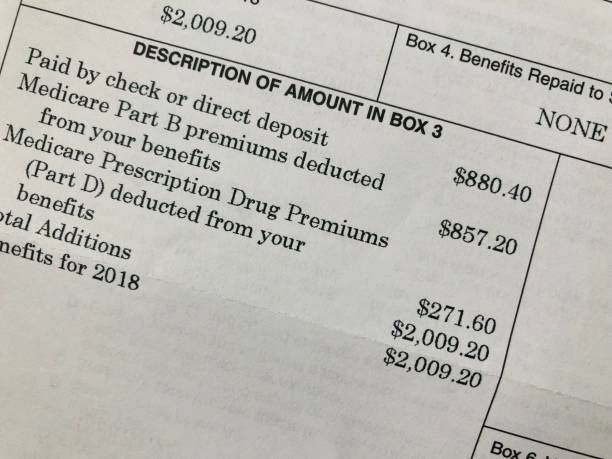

With Medigap, prescription drug coverage is not included, so a separate Part D plan is typically added to ensure complete coverage.

Which Plan Is Right for Your Retirement?

When deciding between Medicare Advantage vs. Medigap, there is no one-size-fits-all answer. The right choice depends on several personal factors, including:

- Your current and expected healthcare needs

- Your monthly budget and tolerance for out-of-pocket costs

- Whether you prefer provider flexibility or structured networks

- How often you travel or receive care outside your local area

For retirees who want lower monthly premiums and bundled benefits, Medicare Advantage may be a good fit. For those who value predictability, provider freedom, and long-term stability, Medigap may be the better option.

It’s also important to consider enrollment timing and future flexibility, as switching plans later may involve underwriting or limited enrollment windows.

How Senior Insurance Advisors Can Help

Navigating Medicare options can be confusing, but you don’t have to do it alone. At Senior Insurance Advisors, we take the time to understand your unique situation and walk you through the differences between Medicare Advantage vs. Medigap in clear, simple terms.

Our goal is to help you choose coverage that supports your health, protects your finances, and gives you peace of mind throughout retirement.

Ready to Find the Right Medicare Plan?

The right Medicare plan can make a meaningful difference in your retirement years. Whether you’re enrolling for the first time or reviewing your current coverage, we’re here to help you make a confident, informed decision.

Contact Senior Insurance Advisors today to get personalized guidance, a free quote and find the Medicare plan that best fits your retirement needs.