Medicare is a critical healthcare program for millions of Americans either aged 65 and older or who have certain disabilities. Each year, the designated period known as Medicare Open Enrollment allows these beneficiaries to be ready and select different policies. However, many Americans aren’t sure how to navigate these sophisticated plans, leaving them in the dark. That’s why we’re here to help you navigate this recurring period and choose the best possible plans.

Being Ready for Medicare Open Enrollment

Medicare Open Enrollment is an annual period that allows Medicare beneficiaries to fine-tune their coverage. Lasting from October 15th to December 7th, this is a vital opportunity to evaluate and adjust your plan. Failing to take advantage of this period could mean that you’re enrolled in the wrong plan for an entire year, potentially resulting in higher costs or inadequate coverage. Therefore, taking advantage of this open enrollment window is crucial to making the most of your Medicare benefits.

1. Evaluate Your Current Coverage

The first step in preparing for Medicare Open Enrollment is to assess your current coverage by asking a few questions.

- Are you satisfied with your current plan?

- Have your healthcare needs changed over the past year?

- Do you anticipate any upcoming medical procedures or prescription drug needs?

Answering these questions will help you determine if your existing plan still works best for you. Changes in your health or medical services can significantly impact your current plan’s effectiveness. Consequently, a thorough evaluation of your current coverage is the foundation upon which you can build a more tailored healthcare plan during open enrollment.

2. Explore Your Options

During the Open Enrollment period, you can explore alternative Medicare plans. This might include switching to a Medicare Advantage Plan or changing your Part D coverage. Take the time to research and compare different plans available in your area, considering factors like premiums, deductibles, coverage limits, and out-of-pocket costs. Like shopping for the best deal, you won’t miss out on more cost-effective or comprehensive plans that could better suit your needs. The effort invested in comparing plans can lead to significant savings and improved healthcare coverage.

3. Review Your Medications

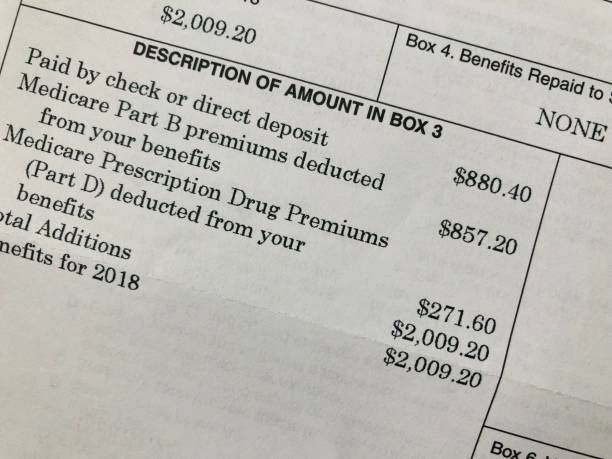

If you have a prescription drug plan (Part D), it's crucial to review your current medications and check if you can obtain them at an affordable cost. This is because it’s not uncommon for a plan’s coverage to change from year to year.

Additionally, different plans have varying tiers and co-pays for medications, so reviewing your options can simultaneously minimize your coverage and satisfy your medical needs. This step can be especially significant for those who rely on ongoing medications to manage chronic conditions.

4. Seek Professional Guidance

Making big decisions about your Medicare coverage can be quite complex and stressful. However, we recommend meeting with a Medicare advisor or consultant If you're not sure where to turn. These professionals can provide personalized guidance that helps you navigate any intricate plan, ensuring that your choices align with your health and financial objectives. By scheduling a consultation during Open Enrollment, you can craft a well-informed plan that provides the optimal balance of coverage and cost savings.

The Expertise of a Local, Licensed Agent

Medicare Open Enrollment is a valuable opportunity for beneficiaries to get ready and adjust their healthcare coverage as needed. By understanding the basics of Medicare, evaluating your current coverage, exploring your options, reviewing your medications, and seeking professional guidance, you can make informed choices that ensure you have the right coverage for your healthcare needs.

Meet with

our advisor so you can secure the peace of mind and financial security that proper healthcare coverage offers. With her careful consideration and proactive planning, you can confidently navigate Medicare Open Enrollment, knowing that you've optimized your healthcare coverage. Call us to

schedule a consultation and secure your medical future today!